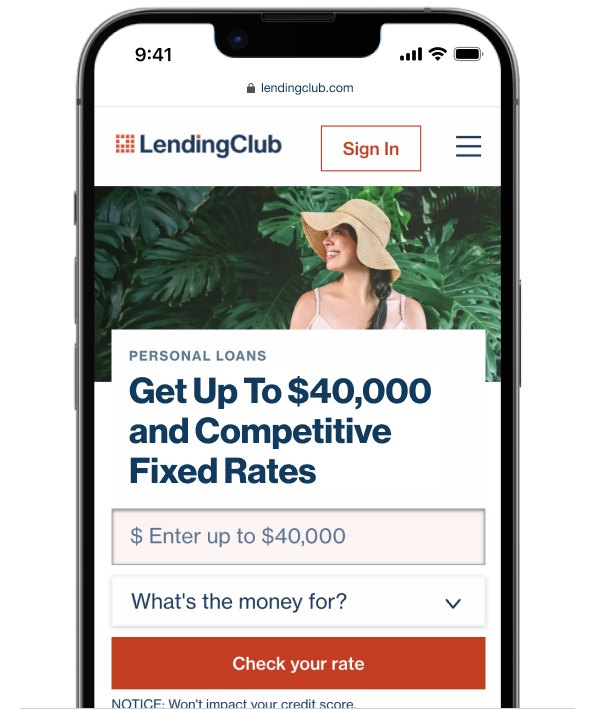

Personal Loans

Get Up To $40,000 and Competitive Fixed Rates

Why Choose a Personal Loan?

A personal loan allows you to borrow money from a lender for almost any purpose, typically with a fixed term, a fixed interest rate, and a regular monthly payment schedule. Collateral is usually not required and personal loans typically have lower interest rates than most credit cards.

Since interest rates and loan terms on a personal loan are fixed, you can select a loan and payment amount that fits within your budget—which is great when you’re consolidating debt. Plus, you’ll know the exact date your loan will be fully paid off.

Using a personal loan to consolidate high-interest credit card debt might even help you improve your credit score, by diversifying your credit mix, showing that you can make on-time monthly payments, and reduce your total debt.

Join Over 4 Million Members Nationwide

Borrow up to $40,000

Receive money fast, upon approval

Competitive fixed rates and fixed monthly payments

No prepayment fees

Automatic payment withdrawals

Personal Loans to Match Your Financial Goals

Credit Card Consolidation Loans

Balance Transfer Loans

Debt Consolidation Loans

Home Improvement Loans

LendingClub Bank Personal Loans Comparison

Information specific to LendingClub Bank is valid as of March 8, 2024. Information specific to other entities sourced from their public-facing websites as of January 6, 2023.

A personal loan allows you to borrow money from a lender for almost any purpose, typically with a fixed term, a fixed interest rate, and a regular monthly payment schedule. Collateral usually is not required.

You can use a personal loan for almost any purpose, with a few exceptions. LendingClub Bank members often use personal loans to pay off credit cards at a lower rate, consolidate debt, or take care of unexpected costs.

A few ways a personal loan from LendingClub Bank cannot be used include anything related to education after high school, making investments (such as securities or cryptocurrency), or funding any illegal activity.

To qualify for a personal loan from LendingClub Bank you must be a U.S. citizen or resident and at least 18 years of age with a verifiable bank account. (We accept applications from all U.S. states and Washington, D.C. We do not accept applications from the U.S. territories)

Your loan application will be evaluated based on several factors, including the information provided by you and the credit bureaus, your credit score, and your ability to repay. For the lowest rates, it helps if you have a higher than average credit score, a low debt-to-income ratio, and a good credit history. Often, applying with another person can help you qualify for a better rate and/or larger loan amount.

Learn how adding a coborrower can help you get approved for a personal loan.

You can apply and complete the entire process online in minutes from the comfort of your home using your phone, laptop, or tablet. Loan approval, and the time it takes to issue a credit decision, are not guaranteed and individual results vary based on creditworthiness and other factors.

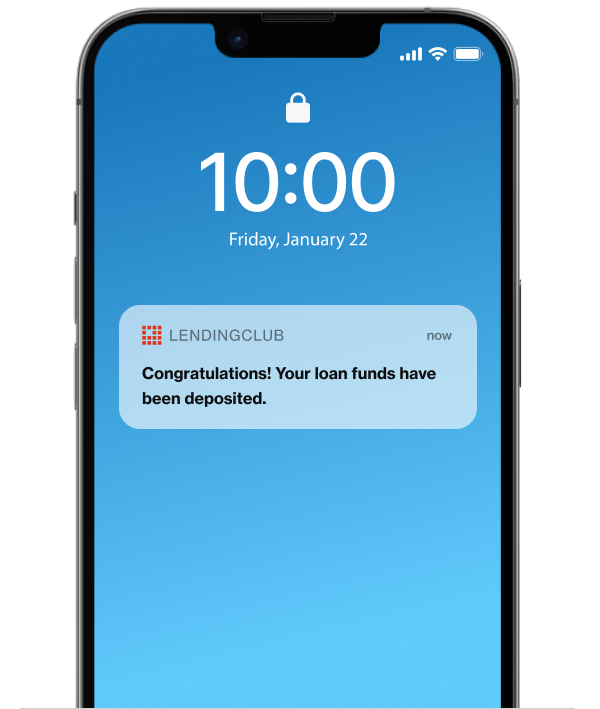

If your loan is funded, your money will be sent directly to your creditors and/or deposited into your bank account.

You can help keep things moving along by checking your to-do list and making sure you have submitted all the documents and information requested.

Checking your rate from LendingClub Bank has no impact to your credit score because a soft credit pull is used. A hard credit inquiry, which is visible to you and to others, and which may affect a person’s credit score, only appears on the person’s credit report if and when a loan is issued.

The good news is that a personal loan could positively impact your credit down the road if you’re able to show a history of on-time payments and a reduction in overall debt (that means no new debt, such as higher credit card balances).

Learn more about your credit score and how to protect your credit health.

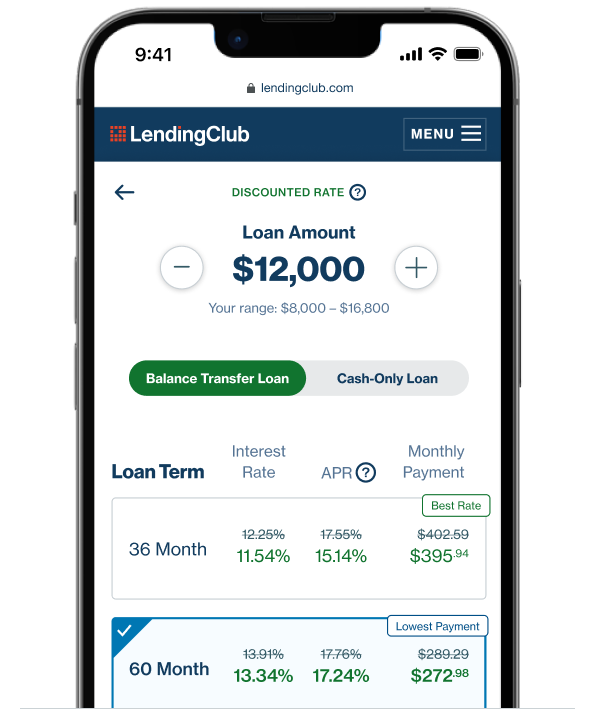

Choose your offer

You’ll be able to select the loan amount, interest rate, APR, monthly payment, and loan term.

Confirm your information

We ask for your Social Security number and details on your income and employment. If we need any other documents or information, we'll let you know in your to-do list. Then, hold tight while we look for your investors on our marketplace and wrap up your loan.

Get funded

Once your loan is approved, we’ll send the money straight to your bank account, and/or pay your creditors directly if you choose this option.