Funeral Loans

Personal Loans to Help with Funeral Costs

How much do you need?

How Can a Personal Loan Help?

Faced with making quick decisions about funeral financing, grieving loved ones often turn to variable, high-interest-rate credit cards. A competitive, fixed-rate personal loan can quickly get you the money you need to cover burial, cremation, and other funeral-related expenses. Predictable monthly payments on a defined repayment term can give you peace of mind.

Join Over 4 Million Members Nationwide

Borrow up to $40,000

Quick and easy online application

Eligibility based on credit history

Receive money fast upon loan approval

No prepayment fees

Why Get a Funeral Loan?

Lock in a Fixed Rate

Cover All Costs

Peace of Mind

Funeral costs can add up quickly. A funeral loan can help make sure those expenses are covered.

Traditional burials and embalming services, cremation, and eco (redwood forest) options

Funeral home service fees

Memorial service fees

Funeral plot and grave marker or headstone

Casket or vault

Burial clothes, including composting suits

Urn

Hearst and transportation

Officiant

Musician

Flowers and wreaths

Travel arrangements for family members

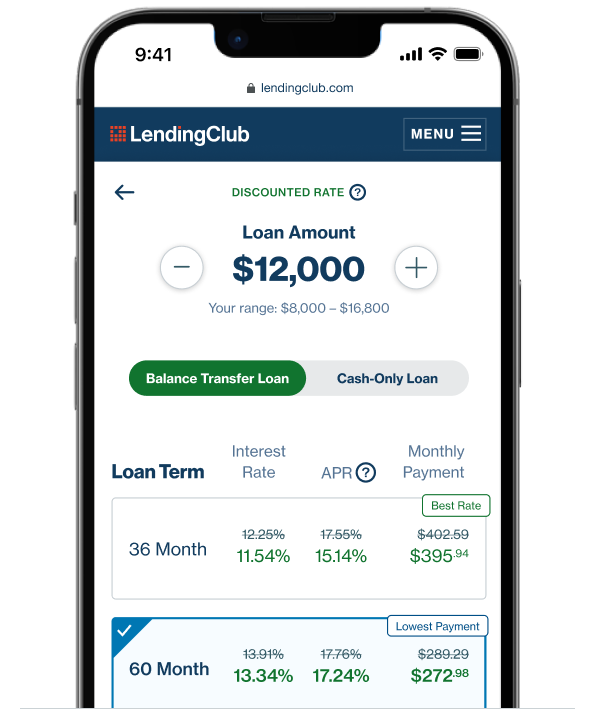

A personal loan for funeral expenses can be a quick and affordable option during an emotional, stressful time. With LendingClub, you can check your rate without obligation or impacting your credit score. Upon loan approval, money is deposited directly into your bank account, typically within two days.

You’ll then make fixed monthly payments for the duration of your repayment term. If at some point you decide to pay off your loan early, no prepayment fees will be applied.

When deciding which personal loan lender is right for you, you’ll want to compare:

Loan amounts: Loan amounts vary by lender and eligibility criteria. Funeral services can be costly. Make sure the minimum and maximum loan amounts align with your needs.

Interest rate ranges: Interest rates vary by lender. The lower your interest rate, the less your loan will cost overall.

Eligibility: Loan approvals are typically based on credit score, payment history, and income, among other factors.

Fees: Application costs, origination fees, and prepayment penalties vary by lender and may impact your total cost. Compare APRs across different lenders to understand the true cost of each loan offer.

Joint applications: If you think you might not qualify on your own based on your credit history, work with a lender that accepts co-borrowers and apply together for a joint personal loan.

Timing: Funeral loans are often time sensitive. Make sure the timing from loan application to funding will work for your needs.

Personal Loans vs. Credit Card Comparison

Personal Loans

- Installment loans can help you pay down debt and take control of your budget

- Single, fixed rate monthly payment is easy to manage

- Fixed monthly payment and payoff date saves you money over time

- Lower average APRs compared to credit cards1

Credit Cards

- Revolving credit accounts can lead to overspending

- Managing multiple credit cards with variable due dates, limits, and terms is time consuming and stressful

- Low minimum monthly payments and revolving compound interest can trap you in a cycle of debt

- Higher average APRs are an expensive way to pay for large purchases

When you're considering a loan to pay for funeral costs, your credit and payment history play a big role in determining if you qualify, and the rates and terms you receive.

LendingClub lets you check your rate without obligation or a hard credit inquiry.

Many online lenders offer unsecured personal loans you can use to pay for funeral costs. While most online lenders do not require a pre-existing relationship, some banks and credit unions may require you to have an established account before you can apply. Some lenders let you check your rate with a soft credit inquiry, which won’t impact your credit score. To get the best deal, look for lenders who offer no fee loans and compare multiple interest rates.

You may get a personal loan to pay for funeral expenses if your credit scores are below fair. However, you may be limited in what interest rates, terms, and amounts are offered. Submitting a joint application with someone who has good credit can improve your chances of getting a larger loan offer with a more favorable rate.

Many funeral homes today expect payment in full and in advance (or a partial upfront payment at the minimum). If you have time to prepare, compare service costs between funeral homes. Some funeral directors offer payment plans, but these are generally only available to people who are prepaying for their own services.

The cost of a funeral varies widely depending on your location and the services you want. According to the National Funeral Directors Association, the median nationwide cost for a funeral with a viewing and burial is $7,640. Including a vault raises the median to $9,135, while specialty services can be higher. This also doesn’t account for additional charges like markers, obituaries, and monuments.

If you simply can’t come up with the money to pay for burial or cremation costs, you still have options. To start with, if you can't afford to pay for burial costs, state or local governments may be able to provide financial assistance.

The Social Security Administration pays a small grant to eligible beneficiaries to offset some funeral costs. Also, other state and federal government programs may help with emergency funeral funds. Keep in mind federal funding may only be available for certain circumstances, such as when a loved one is eligible for veterans’ burial benefits.

You may also be able to raise money from crowdfunding or local charitable organizations.