SMALL LOANS

Protect Your Savings With a Small Personal Loan

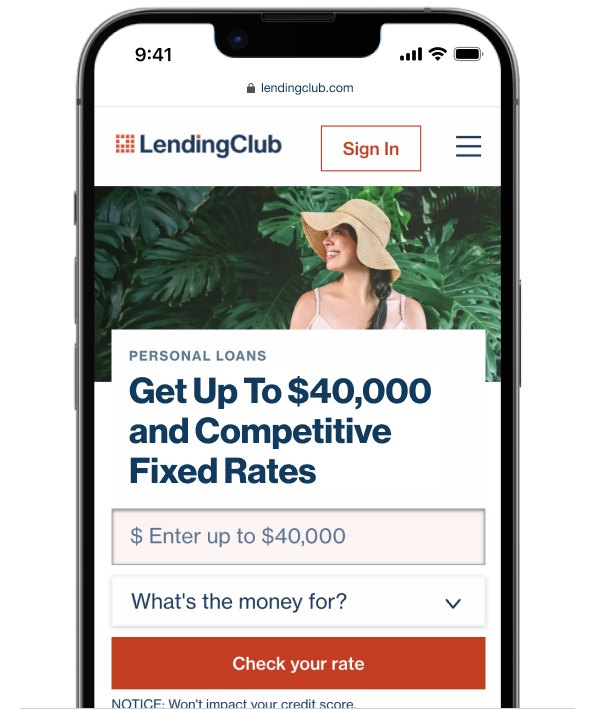

How much do you need?

What Is a Small Loan?

A small loan from LendingClub Bank is a fixed-rate personal loan that can help you get exactly what you need to pay down high-interest debt or cover your expenses now while keeping your monthly payment the same for the duration of your repayment plan. A small personal loan can start as low as $1,000 and offers competitive rates.

When you need to borrow a small amount of money to cover unexpected expenses and don’t want to dip into savings, a personal loan is a smart alternative to high-interest credit cards or other expensive options like payday or auto title loans.

Join Over 4 Million Members Nationwide!

Borrow a small amount, only what you need

Quick and easy online application

Eligibility based on credit history

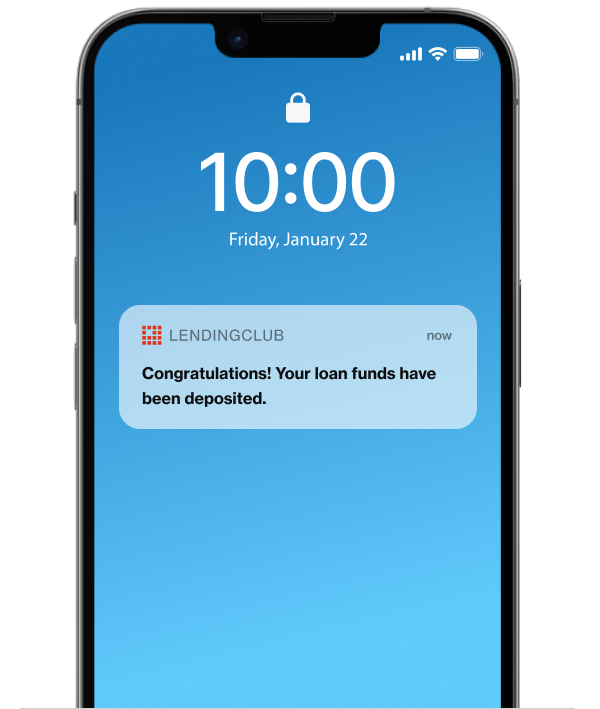

Receive money quickly, upon loan approval

No prepayment fees

Why Get a Small Loan?

Get Cash Fast

Protect Your Savings

Lock in a Fixed Rate

Small loans offer big flexibility, allowing you to cover nearly any expense with fixed monthly payments.

Debt consolidation

Car repairs

Home repairs and upgrades

Major appliance purchases

Electronics purchases

Veterinary bills

Medical expenses

Moving and relocation

With LendingClub, you can check your rate on a personal loan for small expenses or debt consolidation without obligation or impacting your credit score. Once you’ve found the best option, you’ll complete the application process, including a hard pull of your credit report, and a review of your debt-to-income ratio, overall debt, and income.

In many cases, you can complete the process entirely online. Once your loan is approved, money is deposited directly into your bank account typically within two days, so you can cover your expenses right away. You’ll then be able to make fixed monthly payments for the duration of your repayment term. If at some point you decide to pay off your loan early, no prepayment fees will be applied.

When deciding which personal loan lender is right for you, you’ll want to compare:

Loan amounts: Loan amounts vary by lender and eligibility criteria. Some lenders may set minimum loan amounts higher than you need.

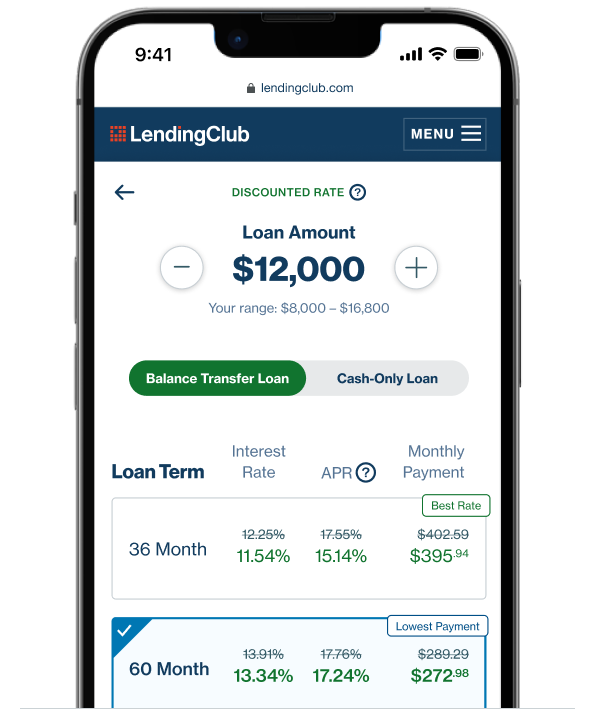

Repayment terms: A longer loan term can lower your monthly payment, but a shorter term will cost you less overall.

Interest rate ranges: Interest rates and APRs vary by lender. The lower your APR, the less your loan will cost overall.

Eligibility requirements: Loan approvals are typically based on your credit score, payment history, and income, among other factors.

Fees: Application costs, origination fees, and prepayment penalties vary by lender and may impact your total cost. Compare APRs between different lenders to understand the true cost of each loan offer.

Joint applications: If you think you might not qualify on your own based on your credit history, work with a lender that accepts co-borrowers and apply together for a joint personal loan.

Personal Loans vs. Credit Card Comparison

Personal Loans

- Installment loans can help you pay down debt and take control of your budget

- Single, fixed rate monthly payment is easy to manage

- Fixed monthly payment and payoff date saves you money over time

- Lower average APRs compared to credit cards1

Credit Cards

- Revolving credit accounts can lead to overspending

- Managing multiple credit cards with variable due dates, limits, and terms is time consuming and stressful

- Low minimum monthly payments and revolving compound interest can trap you in a cycle of debt

- Higher average APRs are an expensive way to pay for large purchases